Global Multi-Asset Balanced

Always heading into the right directionSISF Global Multi-Asset Balanced

A market environment of low bond yields, exposed equity markets and high global market risk presents challenges for investors. It is therefore important to identify and make profitable use of opportunities in the global markets, while bearing in mind the risks. Fund manager Ingmar Przewlocka has the ambition, experience and means to achieve target returns in this challenging environment while considering capital preservation. Dynamic asset allocation, with a global orientation, takes centre stage here. The strategy of Schroder ISF* Global Multi-Asset Balanced is thus independent of a benchmark index.

With a global focus and active investment approach, attractive returns can be achieved. This involves active asset allocation, both across and within asset classes. Many investors underestimate the capabilities that are made available through the Schroders multi-asset approach.

Fund Manager, Multi-asset

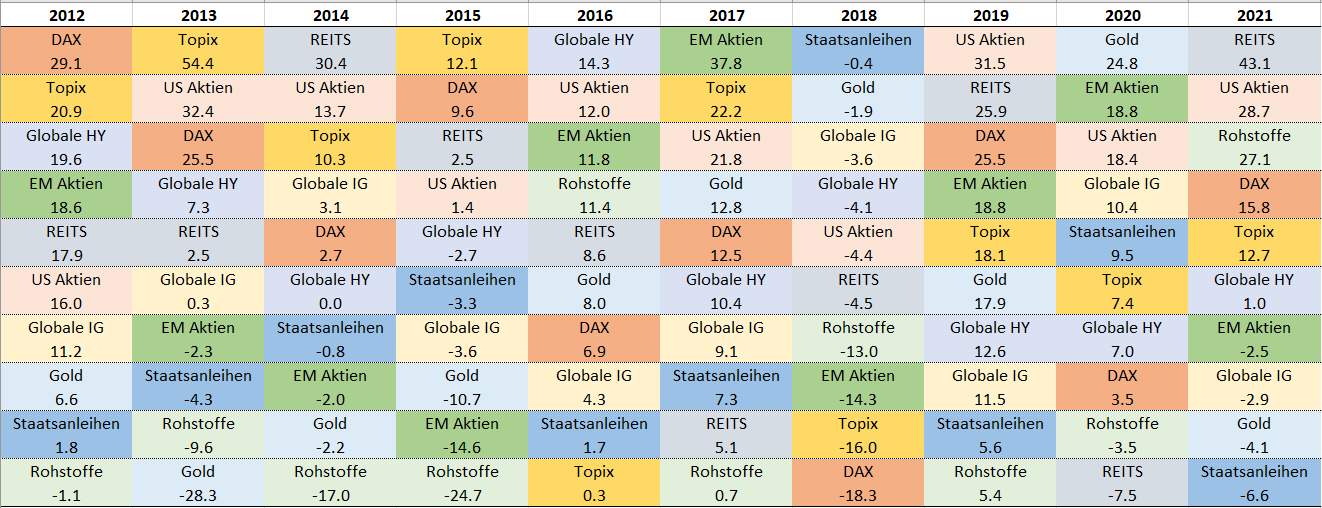

Market drivers change and so favourites change frequently

Performance of selected asset classes

Product highlights

Global

Schroder ISF Global Multi-Asset Balanced invests worldwide in markets that are promising from the perspective of an EUR investor. Schroders' global focus thereby enables continuous identification of investment opportunities worldwide.

Asset allocation

The fund gives access to dynamic asset allocation. It focuses on a balanced combination of strategic and tactical asset allocation.

Schroders' research capabilities

The fund managers can access Schroders' entire global research capacity. This involves use of both quantitative and qualitative analysis tools.

Core solution

Schroder ISF Global Multi-Asset Balanced provides a balanced core component of an investor portfolio, in order to benefit from a diversified and actively managed multi-asset portfolio.

Fund facts

Share class | A, EUR, distributing |

ISIN | LU0776414756 |

Inception date | 2 July 2012 |

Distribution | Fixed distribution of 2 % p.a. |

Maximum initial fee | Up to 4.00 % of the total subscription amount¹ |

Ongoing charges (latest available)² | 1,58 % |

1 (gross method)

2 Ongoing charges (incl. management fee) as of April 11, 2022. This figure may vary from year to year.

SISF Global Multi-Asset Balanced

In our Fund Center you will find all the important information about our Schroder Special Situations Funds: prices, performance, investment objectives, documents

Contact us to discuss how this fund might be right for you.

Important information

All information in the table on fund facts applies to the distributing share class A. For information on other share classes, please refer to the Prospectus.

*Schroder ISF stands for Schroder International Selection Fund.

This content does not constitute an offer to anyone, or a solicitation by anyone, to subscribe for shares of Schroder International Selection Fund (the “Company”). Nothing on this page should be construed as advice and is therefore not a recommendation to buy or sell shares. Subscriptions for shares of the Company can only be made on the basis of its latest Key Investor Information Document and prospectus, together with the latest audited annual report (and subsequent unaudited semi-annual report, if published), copies of which can be obtained, free of charge, from Schroder Investment Management (Europe) S.A. An investment in the Company entails risks, which are fully described in the prospectus. Past performance is not a reliable indicator of future results, prices of shares and the income from them may fall as well as rise and investors may not get the amount originally invested. Schroders has expressed its own views and opinions in this document and these may change. Schroders will be a data controller in respect of your personal data. For information on how Schroders might process your personal data, please view our Privacy Policy available at or on request should you not have access to this webpage. Issued by Schroder Investment Management (Europe) S.A., 5, rue Höhenhof, L-1736 Senningerberg, Luxembourg. Registered No. B 37.799. For your security, communications may be taped or monitored.

Risk considerations

Credit risk: A decline in the financial health of an issuer could cause the value of its bonds to fall or become worthless.

Currency risk: The fund may lose value as a result of movements in foreign exchange rates.

Emerging Markets & Frontier risk: Emerging markets, and especially frontier markets, generally carry greater political, legal, counterparty, operational and liquidity risk than developed markets.

High yield bond risk: High yield bonds (normally lower rated or unrated generally carry greater market, credit and liquidity risk.

Liquidity risk: In difficult market conditions, the fund may not be able to sell a security for full value or at all. This could affect performance and could cause the fund to defer or suspend redemptions of its shares.

Operational risk: Operational processes, including those related to the safekeeping of assets, may fail. This may result in losses to the fund.

Performance risk: Investment objectives express an intended result but there is no guarantee that such a result will be achieved. Depending on market conditions and the macro economic environment, investment objectives may become more difficult to achieve.

IBOR: The transition of the financial markets away from the use of interbank offered rates (IBORs) to alternative reference rates may impact the valuation of certain holdings and disrupt liquidity in certain instruments. This may impact the investment performance of the fund.

Derivatives risk – Efficient Portfolio Management and Investment Purposes: Derivatives may be used to manage the portfolio efficiently. A derivative may not perform as expected, may create losses greater than the cost of the derivative and may result in losses to the fund. The fund may also materially invest in derivatives including using short selling and leverage techniques with the aim of making a return. When the value of an asset changes, the value of a derivative based on that asset may change to a much greater extent. This may result in greater losses than investing in the underlying asset.